When it comes to purchasing a home, securing a mortgage pre-approval is one of the first and most important steps in the process. A pre-approval not only helps determine how much you can afford, but it also demonstrates to sellers and real estate agents that you are a serious, qualified buyer. Without this essential step, you risk wasting time and energy on properties that may be out of your financial reach. In today’s competitive real estate market, mortgage pre-approval can give you a significant edge, providing both clarity and confidence as you understanding your home-buying journey.

Table of Contents

ToggleWhat is Mortgage Pre-Approval?

Mortgage pre-approval is the process by which a lender evaluates a borrower’s financial situation to determine how much they are willing to lend for a mortgage. During pre-approval, the lender reviews factors like income, credit score, debt, and assets to assess the borrower’s ability to repay a loan. This process typically involves submitting financial documents such as pay stubs, tax returns, and bank statements.

Getting pre-approved gives homebuyers a clearer idea of what they can afford and shows sellers that they are serious and capable of securing financing. A pre-approval letter from a lender also strengthens a buyer’s position when making an offer on a home.

Why Pre-Approval Matters

Mortgage pre-approval is important because it gives you a competitive edge in today’s fast-paced housing market. Sellers prefer buyers with pre-approval letters, as it shows you’re serious and financially capable, with 86% of sellers prioritizing these buyers. Pre-approved buyers typically close 2-3 weeks faster and are three times more likely to successfully complete the purchase. Pre-approval also provides a clear understanding of your budget, helps you close quicker, and strengthens your negotiating position, making you a more attractive and reliable option for sellers.

The Pre-Approval Process

The pre-approval process is a simple step to find out how much a lender is willing to lend you for a mortgage. Here’s how it works:

- Application: First, you fill out a loan application with basic information like your income, employment, and any debts.

- Documents: You’ll need to provide documents like pay stubs, tax returns, bank statements, and proof of assets so the lender can check your financial situation.

- Credit Check: The lender will check your credit score to see how reliable you are at paying back debt.

- Review: The lender reviews all your information to decide how much they are willing to lend you and what the terms might be.

- Pre-Approval Letter: If everything looks good, the lender gives you a pre-approval letter, which tells you how much you can borrow. This helps you know your budget when shopping for a home.

Benefits for Different Buyers

1. First-Time Homebuyers

- Understand Your Budget: Pre-approval helps you know how much money you can borrow, so you don’t waste time looking at homes that are out of your price range.

- Learn About Loan Programs: You’ll find out what loan options are available to you, like first-time homebuyer programs, which could offer lower down payments or special rates.

- Identify Credit Issues Early: The pre-approval process shows any credit problems you may need to fix before buying, so you can address them ahead of time.

- Build Confidence: Knowing how much you can borrow and what to expect makes you feel more confident in your home search.

2. Seasoned Investors

- Quick Closing: Pre-approval makes it faster to close on a home because you’ve already been approved for the loan.

- Portfolio Lending: Investors can look into special loan options, like portfolio loans, which may offer more flexibility for multiple properties.

- Multiple Property Strategies: Pre-approval helps you plan strategies for buying several properties, since you already know how much you can afford.

- Investment Property Rates: It helps you secure better rates for investment properties, which may be different from regular homebuyer loans.

3. Real Estate Professionals

- Higher Quality Leads: Pre-approval helps agents work with more serious buyers, making it easier to close deals.

- Faster Transactions: Buyers who are pre-approved can close faster, which means less waiting and more deals.

- Reduced Fall-Through Rates: Pre-approval reduces the chances of a deal falling apart because buyers are already financially approved.

- More Efficient Showings: Agents can focus on showing homes that buyers are likely to be able to afford, making the process quicker and smoother.

Common Mistakes to Avoid

- Shopping before pre-approval: Don’t look at homes until you’re pre-approved for a mortgage.

- Making major purchases: Avoid big buys during the process, as they can affect your loan.

- Changing jobs: Job changes can raise concerns about your income stability.

- Opening new credit accounts: New credit can hurt your chances of approval.

- Missing documentation: Provide all required paperwork to avoid delays.

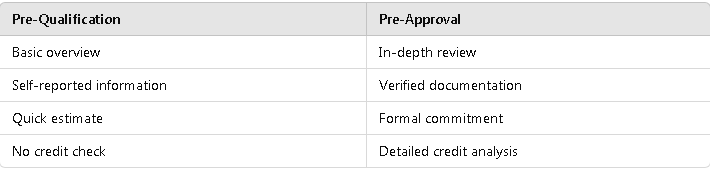

Pre-Qualification vs. Pre-Approval

Pre-qualification gives you a rough idea of how much you might be able to borrow, while pre-approval involves a thorough review and a more reliable commitment from the lender.

Bottom Line

Mortgage pre-approval is a crucial first step in the home-buying process. It not only helps you understand your budget but also shows sellers and real estate agents that you’re a serious, qualified buyer. Without it, you risk wasting time on properties that may be out of your reach. Pre-approval gives you a competitive edge in today’s market, providing clarity and confidence as you move through your home-buying journey. It streamlines the process, strengthens your