Credit scores and mortgage approval is essential for prospective homebuyers. Your credit score is a key factor that lenders use to evaluate your creditworthiness, influencing both your eligibility for a mortgage and the interest rates you may receive. A higher score typically leads to better loan terms and lower borrowing costs. Credit scores affect mortgage approval and provide practical tips for improving your score. By enhancing your credit profile, you can increase your chances of securing a mortgage with favourable conditions, making homeownership more attainable.

Table of Contents

ToggleUnderstanding the Credit Score

A credit score is a numerical representation of an individual’s creditworthiness, typically ranging from 300 to 850. It is calculated based on various factors derived from a person’s credit report, which includes their borrowing and repayment history. Lenders, such as banks and credit card companies, use this score to assess the risk of lending money and to determine the terms of the loan, including interest rates and credit limits.

Key Factors Influencing Credit Scores

- Payment History (35%): This is the most significant factor, reflecting whether you have paid your past debts on time.

- Amounts Owed (30%): This includes your total debt and credit utilization ratio, which is the percentage of available credit that you are currently using.

- Length of Credit History (15%): A longer credit history generally contributes positively to your score.

- New Credit (10%): This considers how many new accounts you have opened recently and the number of hard inquiries on your report.

- Credit Mix (10%): A diverse mix of credit types (credit cards, mortgages, etc.) can enhance your score.

Credit Scores Affect Mortgage Approval

- Loan Approval Chances Lenders use your credit score as a benchmark to gauge how likely you are to repay the mortgage loan. The higher your score, the more likely you are to be approved for a loan. Conversely, a low credit score may result in your application being denied or marked as high-risk, making it harder to get approved.

- Interest Rates Your credit score significantly impacts the interest rate you’re offered. A higher score typically qualifies you for a lower interest rate, which translates to smaller monthly payments and lower total interest costs. On the other hand, a lower credit score might lead to a higher interest rate, resulting in higher monthly payments and more paid in interest over the life of the loan.

- Loan Terms Beyond interest rates, your credit score can affect other loan terms, such as the loan amount and repayment period. Higher scores can open the door to larger loans with more favorable repayment terms, whereas lower scores may limit the loan amount or result in stricter repayment conditions.

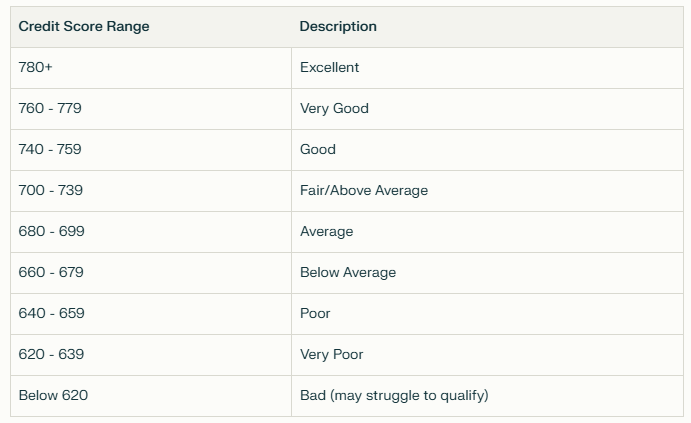

Credit Score Ranges for Mortgages

Most mortgage lenders categorize credit scores into specific ranges to determine approval likelihood and loan terms. Here’s a breakdown of these ranges:

Tips for Improving Your Credit Score

- Pay Your Bills on Time Payment history is the most important factor in determining your credit score. Late payments, defaults, or collections can significantly harm your score. To improve your credit, make sure all your bills—credit cards, loans, and utilities—are paid on time.

- Reduce Your Debt Credit utilization, or the amount of credit you’re using compared to your available credit limit, is another major factor. Aim to keep your credit utilization below 30%. Paying down credit card balances can have a noticeable impact on your score.

- Check Your Credit Report for Errors Mistakes on your credit report can lower your score. Regularly check your credit report for inaccuracies or fraudulent activity. If you find any errors, dispute them with the credit bureau to have them corrected.

- Avoid Opening New Credit Accounts Each time you apply for a new credit account, a hard inquiry is made, which can lower your credit score slightly. Avoid opening new accounts in the months leading up to your mortgage application to prevent unnecessary drops in your score.

- Maintain Old Accounts The length of your credit history also influences your score. Keep older accounts open and avoid closing them, as long as they don’t have high fees. A long credit history with responsible use is seen as a positive by lenders.

- Diversify Your Credit Mix Lenders like to see that you can manage different types of credit, such as credit cards, auto loans, and installment loans. A mix of credit types can boost your score, but only take on new credit if you can manage it responsibly.

Timeframe for Improving Your Credit Score

Improving your credit score is not an overnight process. It can take several months to see significant changes, especially if you’re working to pay down debt or resolve credit report errors. The key is consistency. Stay committed to improving your financial habits, and over time, you’ll see positive results.

Final Thoughts

Improving your credit score is a journey, not an overnight process. Patience, consistency, and strategic financial management are key to unlocking better mortgage options.

Next Steps

- Get your free credit report

- Create a credit improvement plan

- Consult a mortgage professional

Disclaimer: Always seek personalized financial advice tailored to your specific situation.