Financing vs Paying Cash for land is a pivotal decision that can significantly influence your financial landscape and investment outcomes. Each option presents unique advantages and challenges that can affect your overall strategy. Financing allows you to spread the cost over time, potentially preserving your cash flow for other investments or emergencies, while also enabling you to acquire larger or multiple parcels of land. Conversely, paying cash offers immediate ownership, eliminates interest payments, and can strengthen your negotiating position with sellers. Understanding the pros and cons of each approach is essential for making a choice that aligns with your financial goals and circumstances.

Table of Contents

ToggleUnderstanding Land Loans and Paying Cash

Land Loans: A land loan is a type of financing specifically designed to help buyers purchase undeveloped or developed land. Land loans often come with higher interest rates than mortgages due to the inherent risks lenders associate with undeveloped property.

Paying Cash: Paying cash means purchasing the land outright without relying on financing. This can be a straightforward transaction, but it also requires a significant upfront investment.

Financing Land: An Overview

Financing a land purchase involves obtaining a loan, often referred to as a land loan, to cover the cost of the property. This method allows you to acquire land with only a fraction of the purchase price upfront.

Benefits of Financing

- Preserve Cash Flow: Financing enables you to keep cash for other investments or emergencies.

- Leverage: Borrowing allows you to use other people’s money (the lender’s) to invest in appreciating assets.

- Build Credit: Timely loan repayments can strengthen your credit profile.

- Tax Benefits: Interest payments on some land loans may be tax-deductible.

Example:

Suppose the land costs $100,000. With a loan requiring a 20% down payment, you’ll only need $20,000 upfront, keeping $80,000 available for other uses.

Drawbacks of Financing

- Higher Total Cost: Interest payments increase the overall cost of the land.

- Loan Approval Process: Obtaining a loan can involve a lengthy approval process and strict requirements.

- Monthly Payments: Budgeting for ongoing payments adds financial responsibility.

Paying Cash for Land: An Overview

Paying cash involves using your own funds to buy land outright, eliminating the need for loans or monthly payments.

Benefits of Paying Cash

- Full Ownership: Owning the land outright provides peace of mind and simplifies future transactions.

- No Interest Costs: You avoid paying interest, reducing the overall cost of the purchase.

- Faster Transactions: Cash deals close quickly, with fewer administrative hurdles.

- Bargaining Power: Sellers may prefer cash offers and provide discounts.

Example:

If the land price is $100,000, paying cash means no additional interest or fees, and the total remains $100,000.

Drawbacks of Paying Cash

- Reduced Liquidity: Tying up large sums in land may limit your ability to invest elsewhere.

- Opportunity Cost: The cash used could potentially earn higher returns in alternative investments.

- Limited Tax Benefits: Paying cash offers no interest-related tax deductions.

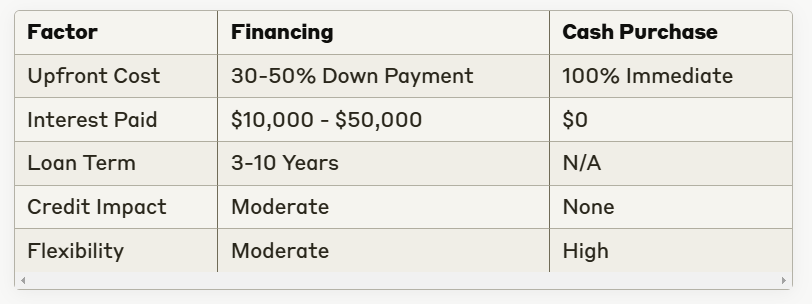

Comparative Analysis

Financial Impact Comparison

Factors to Consider: Financing vs Paying Cash

Investing in land is a significant decision, and selecting between financing vs paying cash requires a careful evaluation of your financial goals and circumstances. Here’s a breakdown of critical factors to help guide your decision:

1. Financial Situation

- Savings and Cash Flow: Assess whether you have sufficient savings to purchase the land outright without compromising other financial goals. It’s essential to ensure that this investment does not strain your overall financial health.

- Affordability of Monthly Payments: If financing vs paying cash, evaluate your ability to manage monthly loan payments comfortably. This includes considering your income, existing debts, and other financial obligations to avoid undue stress on your finances.

2. Long-Term Goals

- Purpose of Purchase: Determine whether the land is intended for immediate use (such as building a home or starting a business) or as a long-term investment. This distinction will influence your decision-making process.

- Potential for Appreciation: Research the likelihood of the land appreciating in value over time. Factors such as location, market trends, and future development plans can significantly impact appreciation potential.

3. Interest Rates and Loan Terms

- Current Interest Rates: Analyze whether current interest rates are favorable for borrowing. Lower rates can reduce overall costs and make financing vs paying cashmore attractive.

- Loan Terms Comparison: Consider how the terms of any potential loans align with your cash flow needs. This includes looking at the length of the loan, monthly payment amounts, and any fees or penalties associated with early repayment.

4. Tax Implications

- Interest Tax Deductions: Investigate whether you can benefit from interest tax deductions if you finance the purchase with a loan. Understanding these implications can help you make more informed financial decisions.

- Cash Payment Strategy: Evaluate if financing vs paying cashfor the land fits into your broader tax strategy. While it may eliminate interest payments, it could also affect liquidity and available funds for other investments or expenses.

Conclusion

Choosing between financing vs paying cashisn’t a one-size-fits-all decision. It’s a nuanced strategy requiring careful evaluation of personal financial circumstances, investment goals, and market conditions.

Key Takeaways

- Assess personal financial health

- Consider long-term investment strategy

- Consult financial advisors

- Evaluate opportunity costs

- Understand market dynamics

Pro Tip: Use online land purchase calculators and consult with local real estate professionals to develop a personalized acquisition strategy.

Recommended Next Steps

- Review personal financial statements

- Research local land market trends

- Consult mortgage specialists

- Develop comprehensive investment plan