A VA loan assumption is a valuable option that allows eligible borrowers to take over someone else’s VA mortgage, keeping the same terms, such as the interest rate and remaining balance. This can be especially helpful in times of rising interest rates, as the new borrower may benefit from a lower rate.

In this guide, we’ll walk you through how VA loan assumption works, who is eligible, and the opportunities it can provide for both the buyer and the seller. Let’s explore how this process can benefit you and those involved.

Table of Contents

ToggleWhat is a VA Loan Assumption?

A VA loan assumption is a process that allows an eligible borrower to take over the existing VA loan of another borrower, effectively inheriting the mortgage’s terms, including the interest rate and remaining balance. This feature is particularly advantageous in a rising interest rate environment, as it enables the new borrower to benefit from potentially lower rates locked in by the original borrower.

Eligibility for Veterans

Who Qualifies?

Veterans have the most straightforward eligibility for VA loan assumptions. You may qualify if you:

Active-Duty or Veteran Status: You must be either actively serving in the military or a veteran who has been honorably discharged. This is a basic requirement for VA loan benefits.

Sufficient VA Loan Entitlement: The VA provides a certain amount of “entitlement” to veterans, which is like a guarantee on the loan. To assume a VA loan, you need enough remaining entitlement to cover the loan.

Credit and Income Requirements: The lender will review your financial stability to ensure you can repay the loan. This includes evaluating your credit score, income, and debt-to-income ratio.

Entitlement Considerations:

-

- Full Entitlement: Allows for loan assumption with minimal restrictions.

-

- Partial Entitlement: May require an additional VA funding fee.

Tip: Check your Certificate of Eligibility (COE) to confirm your entitlement status.

Eligibility for Non-Veterans

To assume a VA loan as a non-veteran, the following criteria must typically be met:

-

- Approval from the Lender: The buyer must apply through the lender servicing the original VA loan.

-

- Credit Score Requirements: Most lenders require a credit score of at least 620, though some may accept scores as low as 580 depending on their policies.

-

- Stable Income: The buyer must demonstrate consistent income to ensure they can manage the mortgage payments.

-

- Assumption Fee: An assumption fee ranging from $500 to $1,500 is usually required.

-

- VA Approval: The transaction must also receive approval from the VA, which involves verifying that the buyer meets financial qualifications.

Unique Scenarios

Certain situations provide additional context for VA loan assumptions:

-

- Spouse of a Veteran: Spouses of veterans may have special privileges when assuming a loan, particularly in cases of divorce or death.

-

- Non-Military Buyers: These buyers must adhere to standard lender qualifications but are not restricted by military service requirements.

-

- Investment Opportunities: Investors may find VA loan assumptions attractive due to favorable financing terms, especially in a high-interest rate environment.

The Assumption Process Explained

Step 1: Initial Application

This is the starting point of the loan assumption process. Here’s what happens:

1 Contact the Current VA Loan Servicer:

-

- Reach out to the lender or servicer managing the loan you want to assume.

-

- They’ll guide you on the specific requirements and next steps.

2 Provide Financial Documentation:

-

- Submit details like income, employment, debts, and assets.

-

- The lender needs this to evaluate your financial health.

3 Credit and Income Verification:

-

- The servicer will check your credit score and financial stability to ensure you can handle the loan payments.

Step 2: VA and Lender Approval

This step ensures both the lender and the VA agree to the assumption.

1 Lender Review:

-

- The lender assesses your financial documents to confirm you meet their criteria.

2 VA Evaluation:

-

- The VA ensures the loan assumption aligns with their guidelines, including checking the loan’s current terms (e.g., interest rate, remaining balance).

3 Approval Decision:

-

- If all requirements are met, the lender and VA approve the assumption.

Step 3: Financial Settlement

Once approved, it’s time to finalize the process.

1 Assumption Fees:

-

- Pay fees related to the assumption, which may include administrative costs.

2 Down Payment:

-

- If the loan balance exceeds the property’s VA loan limit, you may need to make a down payment to cover the difference.

3 Loan Transfer:

- The loan officially transfers to you, and you start making payments under the existing terms.

Financial Considerations

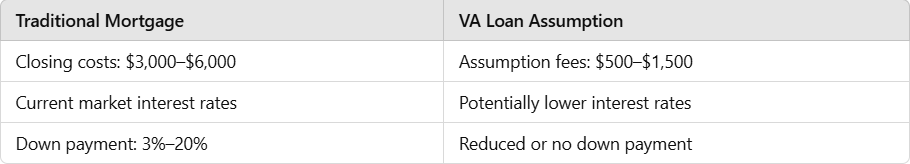

Cost Comparison: Traditional Mortgage vs. VA Loan Assumption

Real-World Example

Assuming a $300,000 VA loan at 4.5% interest:

- Savings on closing costs: $2,500–$4,500.

- Locked-in lower interest rate compared to market rates.

- Lower upfront financial burden for the buyer.

Pros and Cons of VA Loan Assumption

Advantages

- Lower Closing Costs: VA loan assumptions typically involve fewer fees than traditional mortgages, saving buyers money during the home-buying process.

- Potentially Lower Interest Rates: Buyers may benefit from taking over a loan with a lower interest rate than what’s currently available in the market, leading to long-term savings.

- Faster Closing Process: Since the loan terms are already established, the closing process can be quicker compared to securing a new loan.

- Reduced Financial Barriers to Homeownership: With potentially smaller down payments and fewer upfront costs, VA loan assumptions can make buying a home more affordable.

Potential Drawbacks

- Limited Availability of Assumable Loans: Not all VA loans are assumable, and finding a seller with an assumable loan can be challenging.

- Strict Qualification Requirements: Buyers must meet specific credit, income, and lender criteria, which can be a hurdle for some applicants.

- Possible Impact on Seller’s VA Loan Entitlement: If the buyer is not a veteran, the seller may lose part of their VA loan entitlement, limiting their ability to use VA benefits for future home purchases.

- Restrictions Vary by Lender: Each lender has its own rules for approving loan assumptions, and some may impose additional conditions, making the process less straightforward.

Bottom Line

A VA loan assumption lets an eligible buyer take over an existing VA loan, inheriting its terms, like interest rate and balance. It’s a cost-saving option, especially in a high-interest environment, but requires meeting strict eligibility and financial criteria. While it offers lower closing costs, potentially lower rates, and faster processing, challenges include limited availability, lender restrictions, and impacts on the seller’s VA benefits.

Key Takeaways

- VA loan assumption is a powerful alternative to traditional home financing, offering cost-saving opportunities.

- Both veterans and non-veterans can qualify, provided they meet eligibility requirements.

- The process requires careful planning and consultation with VA-approved lenders.

- Always evaluate the financial implications and potential risks before proceeding.