When you apply for a loan or mortgage, lenders want to know you’re financially stable enough to make payments. This is where checking your assets comes in! In simple terms, asset verification is when lenders look at your savings, investments, and other valuable things you own. It helps them make sure you have enough money set aside, whether it’s for a down payment (initial amount you pay), closing costs (fees paid when the deal is finalized), or future payments.

In this guide, you will learn what is asset verification for loan approval, how it works, and why it plays such an important role in securing a loan.

Table of Contents

ToggleWhat is Asset Verification?

In simple terms, asset verification is the process where a lender checks your financial resources to determine if you have the funds needed for a loan or mortgage. This includes verifying money in your bank accounts, investments, real estate, and other valuables.

Why do lenders care? Lenders need assurance that you can repay the loan. Asset verification serves as a financial “safety net,” proving you have the resources to handle mortgage payments, even if you face unexpected expenses.

How Asset Verification Works

Asset verification is a crucial step in the loan approval process, ensuring that borrowers have the financial stability to meet their obligations. The process typically begins with you providing essential financial documents, such as bank statements, investment portfolios, or property details, to demonstrate your available resources. In many cases, lenders use digital tools to streamline this process by securely accessing your bank accounts, with your permission, to confirm balances and account activity.

Once the documents or digital reports are submitted, the lender carefully reviews them to ensure your assets meet specific loan requirements. They don’t just look at the amount but also consider whether the assets are liquid, such as cash savings, or stable, like real estate or stocks. If any discrepancies or missing information arise, the lender may request additional documents or clarifications to complete the verification.

By verifying your assets, lenders gain confidence that you have enough funds for down payments, closing costs, and reserves, making it an essential part of the loan approval process. This step helps lenders minimize risk and ensures that both parties are prepared for a smooth loan experience.

Example: If you’re applying for a $200,000 loan, a lender may require proof of at least $20,000 in savings or investments (reflecting around 10% of the loan amount) to feel confident about your financial standing.

Types of Assets Lenders Evaluate

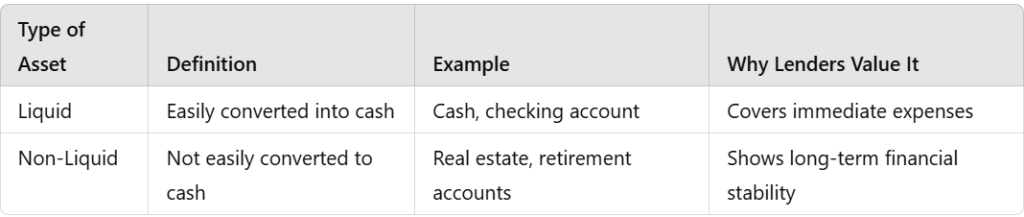

Not all assets are created equal. Here’s a breakdown of liquid vs. non-liquid assets:

- Liquid Assets: Easily accessible funds, such as cash or funds in a checking account, that can be used immediately.

- Non-Liquid Assets: Harder to access quickly, like real estate or retirement accounts, but still add to your overall financial profile.

Common Assets Verified by Lenders:

-

- ✔️ Cash Savings

-

- ✔️ Checking & Savings Accounts

-

- ✔️ Investment Accounts (stocks, bonds)

-

- ✔️ Retirement Accounts (401(k), IRA)

-

- ✔️ Real Estate Properties

The Importance of Asset Verification in Loan Approval for Different Audiences

Asset verification holds unique value for different types of borrowers:

-

- First-Time Homebuyers: When someone is buying a home for the first time, lenders need assurance they can handle monthly payments. Verifying assets—like savings or investments—helps prove that the buyer has a reliable financial cushion. This process establishes credibility, showing the lender that the buyer is financially responsible and able to afford the home.

-

- Seasoned Investors: Investors often take on multiple loans or buy investment properties, so they need to show they have enough liquidity (easy-access funds) and overall financial stability. Asset verification reassures lenders that these investors aren’t overextending themselves and can handle additional financial commitments.

-

- Real Estate Professionals: Agents or brokers helping clients with loans must understand asset verification to guide them through the application process. Knowing what lenders look for helps these professionals prepare their clients, making sure they have the necessary documentation and financial information ready. This guidance can increase the chances of loan approval for their clients.

Comparative Insights: Liquid vs. Non-Liquid Assets

To make things clearer, let’s look at how these assets impact your application:

Quick Tip: When preparing for verification, focus on presenting liquid assets first, as they give lenders more confidence in your ability to handle immediate financial obligations.

Steps to Preparing for Asset Verification

-

- Gather Documents: Collect recent bank statements, retirement account summaries, and investment records.

- Double-Check Balances: Make sure your accounts reflect stable or growing balances.

- Document Large Deposits: For any major recent deposits, be prepared to explain their origin (e.g., bonuses or gifts).

- Organize Real Estate Records: If you own property, keep appraisals and tax records handy.

- Seek Professional Help: Real estate agents or financial advisors can help streamline this process.

Asset Verification Tools & Resources

Here are some resources to help with asset verification:

-

- Asset Calculators: Online calculators can help you assess your total assets and identify areas for improvement.

-

- Financial Document Checklists: Use a checklist to ensure you’ve gathered all necessary documents.

-

- Contact a Real Estate Expert: Need personalized assistance? Consult a real estate professional for guidance.

Conclusion: Your Next Steps in Asset Verification

Asset verification may seem complex, but with preparation, it can become a smooth part of your journey toward homeownership or securing a loan. By understanding the types of assets lenders evaluate, gathering necessary documents, and presenting your financial profile confidently, you can significantly improve your chances of loan approval.

Take Action Now: Start by calculating your total assets or speak with a real estate professional to discuss how to optimize your financial profile for loan applications. This extra step today can save you time and boost your financial future.